EORI Number

When it comes to handling EORI number, PUREPROGRESS is here to ensure a smooth and efficient process. We assist with obtaining and managing your EORI number, helping you navigate the necessary requirements for customs clearance, both within the EU and internationally. Trust us to make the process seamless and hassle-free.

What is EORI Number?

Since November 1, 2009, businesses and individuals in the European Union (EU) must have an EORI number (Economic Operators’ Registration and Identification) for most import and export activities. This unique identifier simplifies customs processes, replacing the former customs number.

For companies or self-employed individuals wishing to import goods from non-EU countries to the EU, an EORI number is essential for customs clearance. Without it, customs procedures cannot be completed unless the importer is a private individual.

For exports, an EORI number is also required for shipments valued over EUR 1,000 or weighing over 1,000 kg. For smaller exports, an EORI number is not necessary. Germany and Switzerland have specific rules for obtaining an EORI number, and our team is here to guide you through the process, ensuring compliance with local and EU customs regulations.

How to Apply for EORI Number?

You can apply for a German EORI number free of charge in two ways: by completing the application form and sending it via email or fax to the Directorate General of Customs, or through the Citizen and Business Customer Portal.

EORI Application Through Form 0870a

Step-by-Step Process:

- To apply for an EORI number, download the application form here: Application for EORI Number. Fill it out online, print all pages, and sign the form.

- Send the completed form via email or fax to the Directorate General of Customs (contact details on the first page).

- For guidance on how to complete the form, refer to the Instructions for Completing the Application.

**LINK FOR INSTRUCTION DOESNT WORK

Download the necessary documents:

EORI Application through the Citizen and Business Portal

You can apply for an EORI number electronically via the Citizen and Business Customer Portal at www.zoll-portal.de. If you already have an account, simply log in here: Login Citizen and Business Portal.

To apply, you must log in with your Elster certificate to verify your identity as either an authorized representative or a private individual. Once logged in, you can submit your EORI application and, if needed, update your information in the customs system.

If you require customs clearance before your EORI number is issued, you can proceed with the help of your customs agent (e.g., PUREPROGRESS GmbH) by providing the transaction number of your EORI application.

FAQs

Is the EORI Number the Same as the VAT ID?

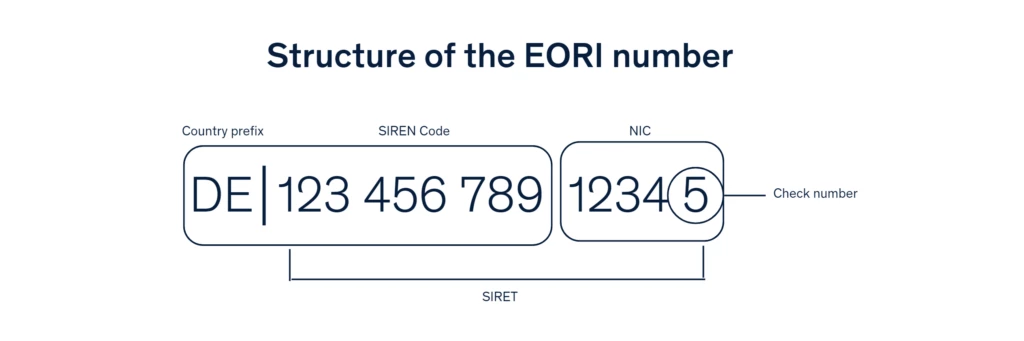

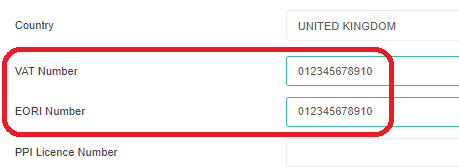

In some countries, the EORI number directly corresponds to the VAT ID (sales tax identification number). However, each country has its own system for assigning the EORI number, and there are no standardized formats. Some countries may include additional codes like “B01” or add zeros before or after the VAT ID, which then forms the EORI number.

In Germany, the EORI number is separate from the VAT ID and cannot be derived using this method.

How long does it take to get an EORI number?

The time required to receive an EORI number can vary by country, ranging from several hours to several days. In some cases, it may take weeks before your EORI number is allocated. However, goods can often be cleared at customs without an EORI number in the meantime. To do so, you typically need to provide a transaction number from your EORI registration (in Austria) or submit a confirmation email/fax showing the transmission of your EORI application.

When is an EORI number required?

An EORI number is required for traders wishing to import goods from non-EU countries into the EU. It is also necessary for exports valued over EUR 1,000 or weighing more than 1,000 kg. The EORI number is issued to both individuals and businesses engaged in profit-making activities, including small businesses and those in agriculture. Private individuals can apply for an EORI number if they export or import more than 10 shipments per year.

When does the EORI number have to be on the invoice?

Some companies that regularly import from the Far East automatically write the EORI number on the supplier’s invoice. This can be done, for example, by writing in the address line so that you also enter your EORI number in the billing address. This procedure may help the customs agent to clear the shipment more quickly. The same applies to shipments that you send to a non-EU country yourself.

However, there is generally no obligation to state the EORI number on the invoice.

Who is exempt from needing an EORI number?

Important: An EORI number is not required in the following cases:

- When applying for an ATA Carnet

- For the registration of relocation goods (moving goods)

- For intra-Community deliveries (shipments within the EU)

For more information about EORI Number please contact the following office:

Office Address

- Directorate General of Customs, Dresden Office

- Master Data Management

- Carusufer 3-5

- D-01099 Dresden

Postal Address

- Generalzolldirektion

- Dienstort Dresden

- Stammdatenmanagement

- Postfach 10 07 61

- D-01077 Dresden

Contact Details

- Applications: [email protected]

- Information: [email protected]

- Hotline: 0351 44834-540

- Fax: 0351 44834-442 / -443 / -444

PUREPROGRESS offers secure and reliable motorcycle transport services, ensuring your bike is handled with care and delivered safely to its destination. Whether it’s a local move or international shipping, our team provides tailored solutions and professional support every step of the way.

Ensure smooth and compliant entry with our specialized customs clearance services. We handle all documentation, tax calculations, and regulatory requirements to guarantee your goods move effortlessly through customs, saving you time and avoiding unnecessary costs.

Looking to transport your car safely and efficiently? Our car transport inquiry service provides tailored solutions for your vehicle’s journey, whether domestic or international. Get in touch today for a personalized quote and seamless service.

Need customs clearance for your pets or animals? We handle all the necessary documentation, special care, and regulatory requirements to ensure a smooth journey for your beloved pets.

Looking for reliable sea freight services? Our sea freight inquiry provides flexible and cost-effective solutions for shipping your goods globally. Whether it’s full container loads (FCL) or less-than-container loads (LCL), we ensure safe, timely, and efficient transport tailored to your needs. Get in touch for a customized sea freight solution that suits your business.