Customs Clearance

When it comes to smooth and efficient customs clearance, PUREPROGRESS is your trusted partner. With expertise in navigating complex customs regulations, we ensure a seamless process for your shipments, both locally and internationally. Whether it’s for vehicle importation, goods transport, or any other customs procedures, we handle everything with precision and care. Explore our comprehensive customs clearance services and let us guide you through the process with ease.

Getting Started With Our Services

PUREPROGRESS offers expert customs clearance services, delivering efficient, reliable, and tailored solutions to meet the unique needs of each client. Whether you’re importing goods, vehicles, or navigating complex regulatory requirements, our team ensures a smooth, compliant process every step of the way. This page provides you with essential information to help you understand the customs clearance process, the services available, and how to choose the best solution based on your specific needs.

Why Choose PUREPROGRESS?

- Fast and Reliable

- Responsive Customer Support

- Broad Network

- Various Options

- Competitive Rates

What Is Customs Clearance?

Customs clearance is the process of ensuring that both goods and vehicles meet all the legal requirements to cross borders. It involves submitting necessary documentation, paying import duties, and complying with regulations specific to each country.

When shipping vehicles to or from Switzerland and Germany, customs clearance is essential for smooth and legal transport. For shipments from Switzerland to Germany (or any EU country), customs clearance is required to handle duties, taxes, and vehicle registration at the border. This is because Switzerland is not part of the European Union (EU), meaning customs checks are mandatory for cross-border vehicle movement.

Similarly, when transporting vehicles from Germany to Switzerland, customs clearance is required to manage import duties, taxes, and any legal obligations, as Switzerland is outside the EU. Our team at PUREPROGRESS ensures that all customs documentation is properly prepared, taxes and duties are calculated, and your vehicle moves across borders without delay.

Switzerland & Germany Customs Clearance

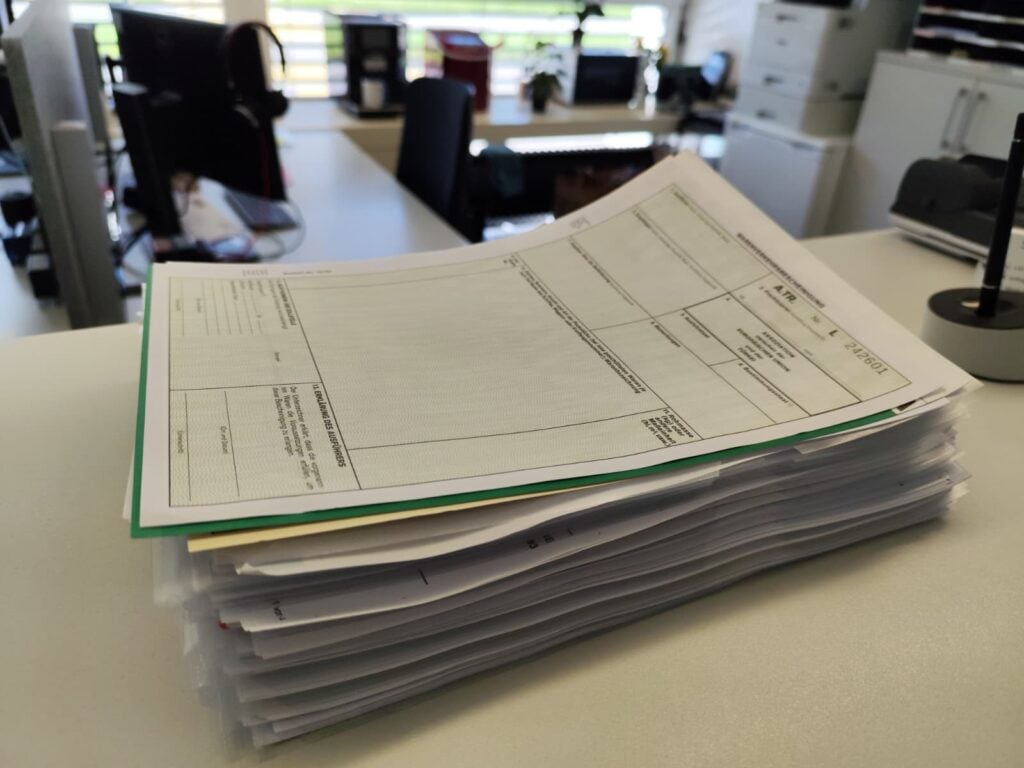

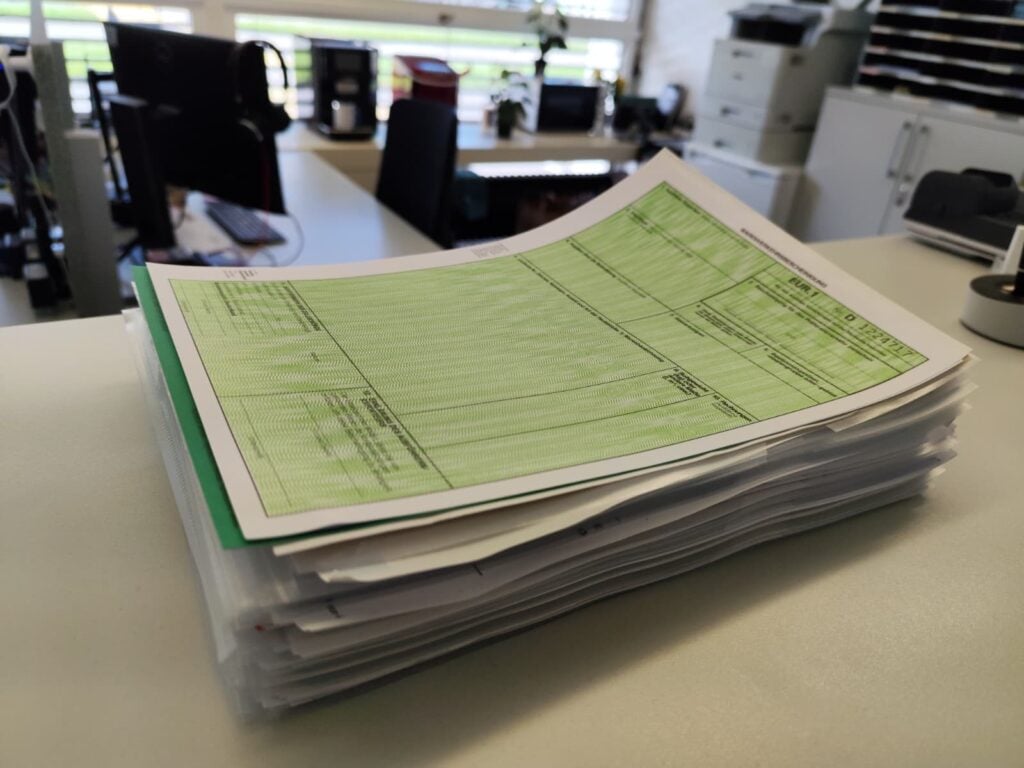

At PUREPROGRESS, we offer efficient customs clearance services across Switzerland and Germany. With our expert team and specialized software, we handle all necessary steps for both imports and exports, ensuring smooth and quick border crossings. Since 2009, we’ve been managing electronic customs declarations through Germany’s ATLAS system, making the process faster and more reliable.

We offer customs clearance and related services for Switzerland imports and exports, including:

- Swiss import/export customs declarations at all Swiss customs offices

- Swiss provisional import declarations & Carnet A.T.A.

- Swiss ZAVV/free pass (temporary import for re-export)

- T1 documents & Swiss movement certificates EUR.1

- Additional forms (goods certificates, form 13.20A for vehicles, customs clearance certificate 15.10 for watercraft)

- Proof of origin procurement

- Applications/clarifications with customs authorities & advice on customs numbers, permits, tariff quotas

We provide customs clearance and related services for German imports and exports, including:

- German import/export customs clearance at all German customs offices

- Inward processing applications (AV-Schein/Single Administrative Document)

- German movement certificates (EUR.1, A.TR) & other forms (clearance certificates)

- Supplier declarations procurement & clarifications with manufacturers/importers

- Applications/clarifications with German customs offices

- Advice on EORI numbers, permits & related applications

Our Customs Clearance Services

At PUREPROGRESS, we offer seamless customs clearance at major airports, sea ports, and railroads in Germany. Our team ensures all documentation is handled efficiently, working closely with customs authorities to expedite the process. Whether you’re transporting goods or vehicles, we ensure a smooth, hassle-free experience so you can keep your logistics on track.

Our Clients Testimonials :

Very friendly and knowledgeable help with clearing our car to Switzerland. When we arrived at the border, all the documents were ready as promised. No annoying questions at customs because everything was clear!

Great service, thank you very much!

– Simone C

I had a classic car imported from Germany. Everything went great, my questions were answered super quickly and competently. The pickup and delivery worked perfectly. I can only highly recommend Pureprogress!

– Daniel F

We had a car transported from Germany to Switzerland including customs clearance. Very friendly and professional contact. Phone calls and emails were always responded to immediately. We can only recommend it.

– Doreen M

PUREPROGRESS offers secure and reliable motorcycle transport services, ensuring your bike is handled with care and delivered safely to its destination. Whether it’s a local move or international shipping, our team provides tailored solutions and professional support every step of the way.

Ensure smooth and compliant entry into Switzerland with our specialized customs clearance services. We handle all documentation, tax calculations, and regulatory requirements to guarantee your goods move effortlessly through Swiss customs, saving you time and avoiding unnecessary costs.

Looking to transport your car safely and efficiently? Our car transport inquiry service provides tailored solutions for your vehicle’s journey, whether domestic or international. Get in touch today for a personalized quote and seamless service.

Need customs clearance for your pets or animals? We handle all the necessary documentation, special care, and regulatory requirements to ensure a smooth journey for your beloved pets.

Looking for reliable sea freight services? Our sea freight inquiry provides flexible and cost-effective solutions for shipping your goods globally. Whether it’s full container loads (FCL) or less-than-container loads (LCL), we ensure safe, timely, and efficient transport tailored to your needs. Get in touch for a customized sea freight solution that suits your business.